VantageScore was created by the three major credit reporting agencies, Experian, Experian, and TransUnion. It’s a lesser-known credit score, but growing in popularity.

It was launched back in March 2006 to take on the ever-popular Fico score, which is reportedly used by 90% of banks and lenders.

The credit reporting agencies developed VantageScore as a means to improve scoring consistency among them, as it’s not uncommon to see a wide range of Fico scores on a tri-merge credit report.

They’ve done this be using the same scoring algorithm – but credit scores will still see some variation based on the data each credit agency receives (creditors send data to different bureaus at different times, and not all send all data to each).

Additionally, the fresh scoring model means it will better reflect recent economic trends and shifts in consumer credit behavior, meaning lenders will have a better idea of the risk we pose.

How is VantageScore Determined?

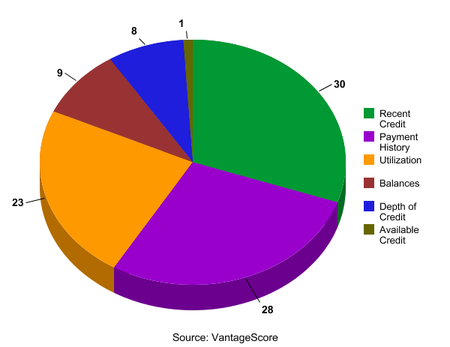

Recent credit is the more important scoring component of VantageScore, making up 30% of your score. It takes into account how many recently opened credit accounts you have, along with recent credit inquiries. So be sure to apply for new credit sparingly to avoid unnecessary credit score dings.

And just like the Fico score, payment history is also a very important scoring component, making up 28% of your score. Simply put, the more consistently you pay accounts on time, the higher your VantageScore.

Not far behind it utilization (23%), which measures how much of your available credit is currently being used. The key here is to keep balances low in order to avoid overextending yourself. Doing so will lead to a higher credit score, and make subsequent requests for new credit more successful.

Balances are the next most important component, making up 9% of your VantageScore. This metric measures the total of your current and delinquent account balances, so the more healthy tradelines you have (and the fewer bad ones), the higher your credit score will be.

Not far behind is depth of credit (8%), which essentially looks at how long your credit history is and if there’s a good mix of credit types (e.g. mortgages, auto loans, credit cards). So the longer you’ve had credit (and a good variety of it), the higher your score.

Lastly, available credit makes up a whopping 1% of your VantageScore. Yep, just one percent. Put simply, this is the total amount of credit you currently have access to. So the more available credit you’ve got, the higher your score.

What’s Not Included in Your VantageScore?

The following isn’t taken into account when measuring your VantageScore:

• Race, color, religion, nationality, sex

• Marital status, age

• Salary, occupation, title, employer, employment history

• Where you live

Highest and Lowest VantageScore

The credit score scale for VantageScore ranges from 501-990, with higher scores representing less credit default risk, and lower scores representing a greater likelihood that you will become delinquent on a credit line or obligation in the future.

VantageScore also has letter grade buckets that divide consumers as follows:

– “A” for scores between 900-990

– “B” for scores between 800-899

– “C” for scores between 700-799

– “D” for scores between 600-699

– “F” for scores 599 and below.

And just like in high school, an A is a whole lot better than an F. The average credit score for VantageScore stood at 748, as of August 2010, per credit bureau Experian.

Where Can I Get My VantageScore?

You can obtain your VantageScore from any of three major credit reporting agencies, and also via some free credit score services. The bank, lender, or creditor you apply with may also pull a VantageScore, so make sure you’re practicing smart credit habits to ensure your credit is up to snuff.