If you’ve ever pulled your own credit scores, you may have been surprised, whether pleasantly or not, to find out that your score wasn’t the same as what your lender came up with.

This is actually a very common scenario, for several reasons, but mainly because the scoring models are different.

You see, there are tons of different credit scores out there, ranging from the popular Fico score most lenders use, to the VantageScore and other scores issued by the individual credit reporting agencies.

There are also consumer credit scores, known as “educational credit scores,” offered for free by companies like Credit Karma and Credit Sesame. These are often referred to as Fako scores.

They’re all based on the same information in your credit file, assuming it makes its way to the company that spits out your credit report and score.

But the way each company dissects your information and comes up with a credit score differs, which explains why the scores vary.

Other issues like timing also come into play. After all, it’s tough for credit scores pulled on different days from different sources to be exactly the same, which is why it’s common to see some divergence.

Additionally, even if the credit score is ordered from the same company, such as Fico, it may be industry-specific, or a newer or older version.

But just how different are the credit scores, and can the difference make or break you?

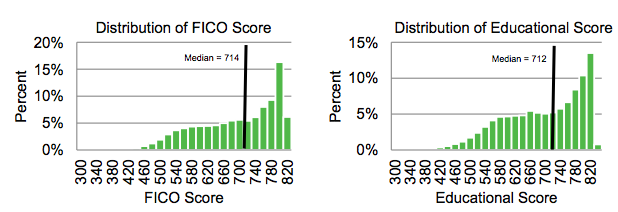

Well, the Consumer Financial Protection Bureau (CFPB) got involved and analyzed 200,000 credit files from the three major credit reporting agencies to see how credit scores sold directly to consumers compared to those sold to lenders.

Consumer Credit Scores Are Pretty Accurate

They found that correlations across the scoring models are pretty high, at over .90 out of a possible 1.0.

In other words, if you have a good credit score with Equifax, there’s a good chance your score will be good with TransUnion or Experian.

Conversely, if you have a bad credit score with TransUnion, chances are you’ll have similarly bad credit with any other bureau that calculates your score.

And your educational credit score should be pretty close to your lender-pulled Fico score.

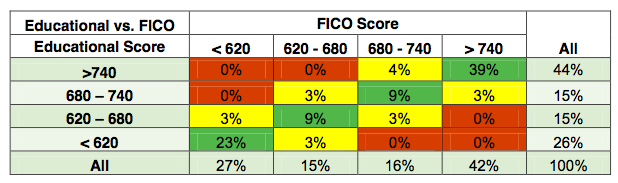

In the study, the CFPB broke down consumer credit scores into four buckets, including:

– Below 620

– Between 620 – 680

– Between 680- 740

– Above 740

Based on those rather important thresholds, they discovered that different credit scoring models placed consumers in the same bucket 73-80% of the time.

So most borrowers with credit scores above 740 had similar scores, no matter where they pulled their credit scores.

But different scoring models pushed a sizable 19-24% of consumer into different buckets, so a consumer with a score between 620-680 may have found themselves in the sub-620 category once their lender pulled their score.

This is highly significant, given the fact that credit scores below 620 are considered subprime, and could result in no financing.

Even worse, 1-3% of consumers could find their credit scores off by two or more categories. So instead of being above 740, one could find their score in the 620-680 bucket instead. Yikes.

The Conclusion

You need to take all credit scores that you receive from anyone other than a lender with a huge grain of salt.

They are simply educational credit scores, and don’t mean anything more than that.

They’re a good way to see where you stand and why, but they’re no guarantee prospective creditors will come up with the same thing.

As a result, the CFPB has recommended that the companies that sell such scores make it abundantly clear that they can vary substantially from scores pulled by lenders.

Other than that, they don’t have a “solution” for this issue.

Tip: If you do happen to find a large variance in your credit scores, you may want to dig a little bit to see what’s causing it.

There’s a good chance something is being reported with one credit reporting agency, but not the other. And you’ll want to know whether it’s legitimate or not.

(photo: eckes/bernd)